In the case of investments, precious metals remain shining and golden investments that could never go out of style. Bulky and shiny gold, silver, platinum, and palladium have piqued people’s curiosity throughout history. They are more than just ornaments. They are forms of currency and insurance against volatile financial markets.

Shedding Light On The World Of Precious Metals Trading

The Enduring Appeal Of Precious Metals

The J. Rotbart precious metals like platinum, gold, silver, or even palladium were, are and will be considered worthy of customers’ interest. Given that they are not very common, their aesthetics enhance their value and ability to be used daily in different fields, making them popular. Gold, generally regarded as the premium metal or often referred to as the ultimate money, has been accepted as a symbol of wealth for centuries. Silver, although prolific, is coupled with several industrial uses and its place in coinage and jewelry.

Understanding The Precious Metals Market

The precious metals market is extensive, exists internationally, and depends on many factors.

Various factors influence metals’ prices, including supply and demand, geopolitics, currencies, and other indicators. It is a permanent market where trading happens all day and night in financial facilities globally. Knowing the top influences and timing for this business will be quite helpful for people willing to enter this market.

Ways To Invest In Precious Metals

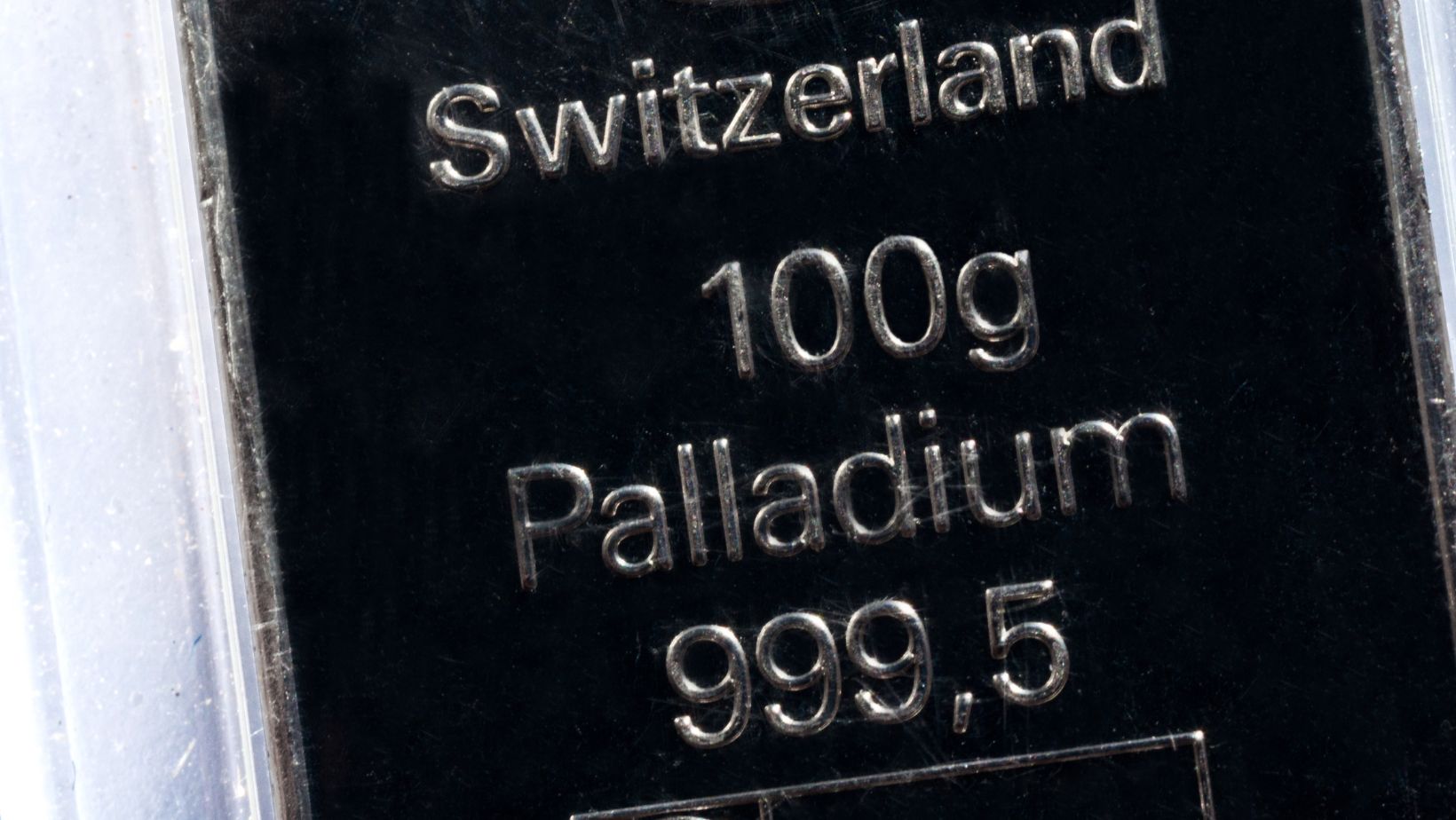

Participation can be made in several forms in precious metals investment vehicles. The first, and probably the oldest, way of owning gold is by buying coins or bars. Housing investing, in particular, has this tangible form that acts as a security measure for many people. There is a more friendly method of investing in metals through Exchange traded funds (ETFs) since one does not have to hold the physical form of the metal in question.

The Basics Of Purchasing Precious Metals

One wrong assumption people have is that you need to buy whole bars, which is not an affordable route for most. However, buying silver coins and creating a collection over time is another way of investing in precious metals. This option is even more affordable than buying gold. Other methods include purchasing stocks in mining companies or mutual funds that specialize in the precious metals market.

Information is your single most potent weapon if you invest in any precious metals. Search for the dealers’ credibility and know the product’s market price today. Know the varieties available with bullion: bars, limited mints, and numismatics situated in the middle. When learning about purchasing and selling precious metals, it’s important to consider the variety of options available, including the selection of silver rounds for sale. All types of investments define specific aspects of purity, weight, and premiums peculiar to each. To this effect, confirming the genuineness of the metals bought is advisable, especially if they are physical products. Since most investors prefer their investments to be associated with minimal risks, they are always relieved to see their resources bearing certifications from accredited assay offices.

Storing and Securing your precious metals

After purchasing physical assets, knowing where and how to store them becomes a very serious issue. Home safes can be very convenient because they are in the homes; hence, they may not be as secure as professional storage facilities.

Another option, the bank safe deposit boxes, is also available, but it has certain limitations concerning access and insurance. When it comes to significant investments in precious metals, specialized firms offer storage services with high-security features.

Selling Precious Metals

The timing and method of when and how to sell are perhaps equally important in the buying process. The holding period contributes significantly to high returns since investors can determine the right time to invest or sell. Monitor economic statistics and worldwide occurrences that can affect the prices of metals. Sell when you are ready, but make sure you are fully informed of the available choices. While you can sell your old coins right at local coin shops, they may give you less for your money.

Concluding

Precious metals are ideal for investment as they combine the historical profits from the investment and strategy of today’s world. However, it is vital to note that precious metals investment has merits and demerits, just like any other investment. If you want to tread into the world of precious metals, careful planning, research, and, probably, even involving the professionals will allow you to avoid big mistakes.