As payment options evolve, consumers are increasingly finding alternatives to traditional credit cards. One of the most popular choices today is the “Buy Now, Pay Later” (BNPL) service, which allows shoppers to make purchases and pay them off in smaller, interest-free installments. While credit cards have long been a mainstay for everyday shopping, BNPL offers a more flexible approach, particularly for younger generations who are keen on managing their finances without taking on high-interest debt.

In this article, we’ll explore the differences between BNPL and credit cards for everyday shopping, looking at factors like spending patterns, fees, and ease of use. Using the latest insights into consumer behavior, we’ll help you decide which option might be better for your day-to-day purchases.

1. Spending Patterns: How Different Generations Use BNPL and Credit Cards

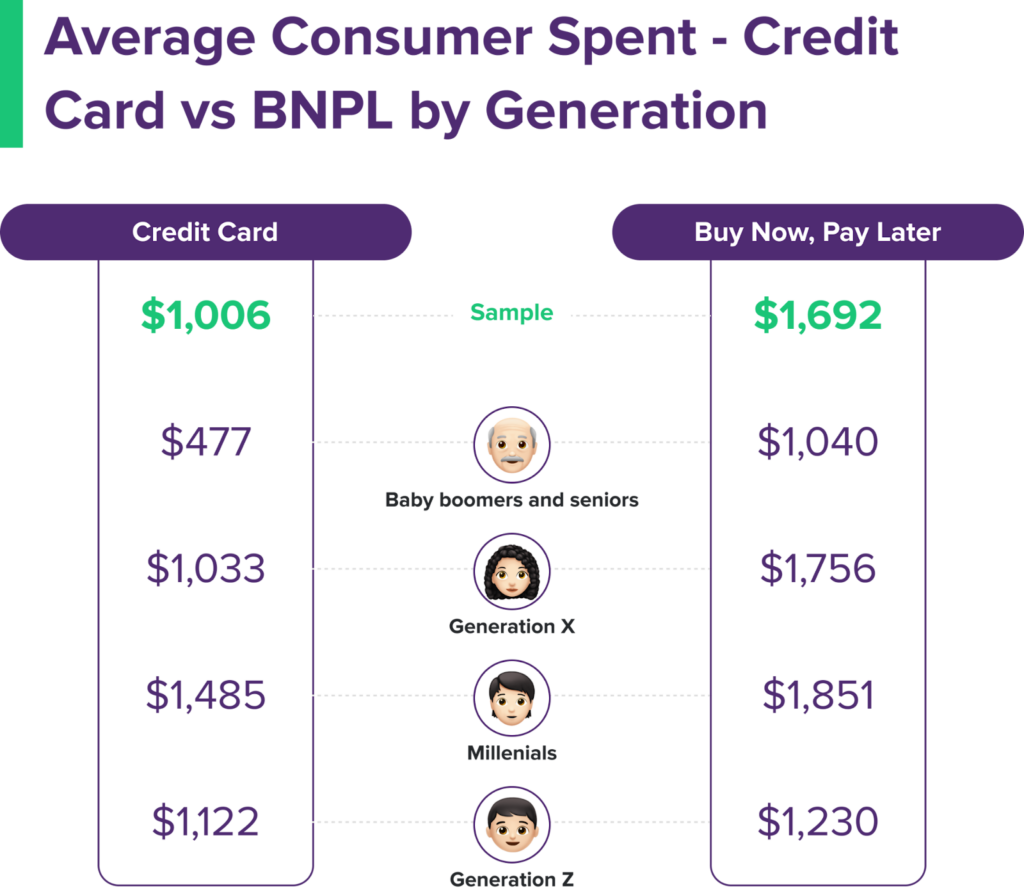

One of the key factors in deciding between BNPL and credit cards is understanding how different generations spend. According to recent data, millennials and Gen Z consumers are increasingly choosing BNPL services over traditional credit cards for everyday shopping. This preference is driven by the desire for flexibility and a straightforward repayment process.

The data shows that:

- Millennials spend an average of $1,851 using BNPL services, compared to $1,485 with credit cards.

- Gen Z shoppers spend around $1,230 on BNPL, while their credit card spending is $1,122.

- Generation X and Baby Boomers, on the other hand, still lean towards credit cards, with average spending higher in this category.

The trend is clear: younger consumers are gravitating towards BNPL for their purchases, especially when shopping online. The higher BNPL spending among younger generations reflects their comfort with digital platforms and their preference for interest-free, manageable payments over revolving credit.

2. Fees and Interest: BNPL’s Advantage Over Credit Cards

A primary reason consumers, especially millennials and Gen Z, are choosing BNPL for everyday shopping is the transparency of fees and interest. BNPL services are typically structured as interest-free installments if paid on time, making them an appealing option for shoppers who want to avoid the high-interest rates associated with credit cards. This is especially relevant for small, everyday purchases where consumers may not want to incur extra costs.

Credit cards, on the other hand, can lead to high-interest charges if balances are not paid off monthly. While many people use credit cards responsibly, others struggle with accumulating debt, paying only the minimum amount due, which increases the amount of interest accrued. With BNPL, there’s no risk of compounding interest, so consumers have a better idea of their financial obligations and can plan their budgets accordingly.

3. Approval Process: Quick and Simple with BNPL

For many consumers, the simplicity of BNPL approval is another factor that tips the scales in its favor. Unlike credit cards, which often require a thorough credit check and may involve other financial background checks, BNPL services typically use a lighter credit assessment or no credit check at all. This enables consumers with limited or poor credit histories to access the service easily, providing them with an alternative way to make purchases.

Credit cards, while beneficial for building a credit history, can be inaccessible for some consumers due to the rigorous approval process. For those who may not have a high credit score, BNPL services offer a more inclusive alternative for financing everyday purchases without the added complexity.

4. Managing Payments: Which Is Easier?

For everyday shopping, BNPL offers a straightforward and predictable payment structure. Purchases are divided into equal payments, usually spread over a few weeks or months, with clear due dates and no additional fees if paid on time. This structure allows consumers to budget more effectively, making it easier to manage expenses without risking a long-term debt cycle.

In contrast, credit cards operate on a revolving credit basis, allowing consumers to carry balances from month to month, but this can lead to accumulating debt if not managed carefully. The minimum payment requirement on credit cards often gives consumers a false sense of affordability, leading them to spend beyond their means. For shoppers who want a clear plan for repaying their purchases, BNPL’s installment approach can be simpler and more appealing.

5. Rewards and Cashback: A Credit Card Advantage

While BNPL offers several benefits, credit cards have the upper hand when it comes to rewards and cashback. Many credit cards provide points or cashback on every purchase, allowing consumers to accumulate rewards that can be redeemed for travel, discounts, or even cash. For those who use their cards responsibly and pay off the balance each month, these rewards can provide added value.

BNPL services typically don’t offer rewards or cashback programs, so consumers who prioritize earning points or receiving discounts on their everyday purchases might find credit cards more appealing. However, some BNPL providers have begun partnering with retailers to offer special promotions, such as discounts or exclusive deals, which could become a more common feature in the future.

6. Building Credit: The Credit Card Advantage

Another advantage of credit cards over BNPL is the ability to build a credit history. Credit card usage is reported to credit bureaus, meaning that responsible use can help consumers improve their credit scores. A good credit score opens up more financial opportunities, such as lower interest rates on loans or the ability to obtain a mortgage.

Currently, BNPL services generally do not report to credit bureaus, so using them won’t help consumers build their credit score. For those who are looking to establish or improve their credit history, using a credit card and paying the balance off regularly can be more beneficial in the long run.

7. Which Is Better for Everyday Shopping?

Ultimately, whether BNPL or a credit card is better for everyday shopping depends on the individual’s financial habits and priorities.

- BNPL is ideal for consumers who prefer a predictable, interest-free repayment plan, want a fast and easy approval process, and are focused on managing their spending without revolving credit.

- Credit Cards are advantageous for those who want to build their credit score, earn rewards, and have the discipline to pay off their balance each month to avoid interest.

For younger generations, BNPL offers the flexibility they desire without the complexities and potential pitfalls of credit cards, which explains its growing popularity. On the other hand, credit cards remain a valuable tool for those looking to establish credit and benefit from rewards programs.

Conclusion

In conclusion, BNPL and credit cards each have their strengths and weaknesses when it comes to everyday shopping. BNPL services appeal to consumers seeking transparency and simple installment plans, particularly for online purchases, while credit cards offer rewards and credit-building potential for those who can manage them responsibly.

Whether you’re a Gen Z shopper looking to avoid debt or a seasoned credit card user maximizing rewards, it’s essential to choose the payment method that aligns with your financial habits and goals. As both options continue to evolve, consumers have more choices than ever to find the solution that best fits their needs.

This comparison between Buy Now, Pay Later services and traditional credit cards was published by ROSHI cash loans, a fintech leader in Southeast Asia. Specializing in digital financing product comparison such as comparing the lowest home loan rates, emergency loans and if you don’t know where to borrow money online. ROSHI is a trusted platform for Singaporeans seeking consumer lending products